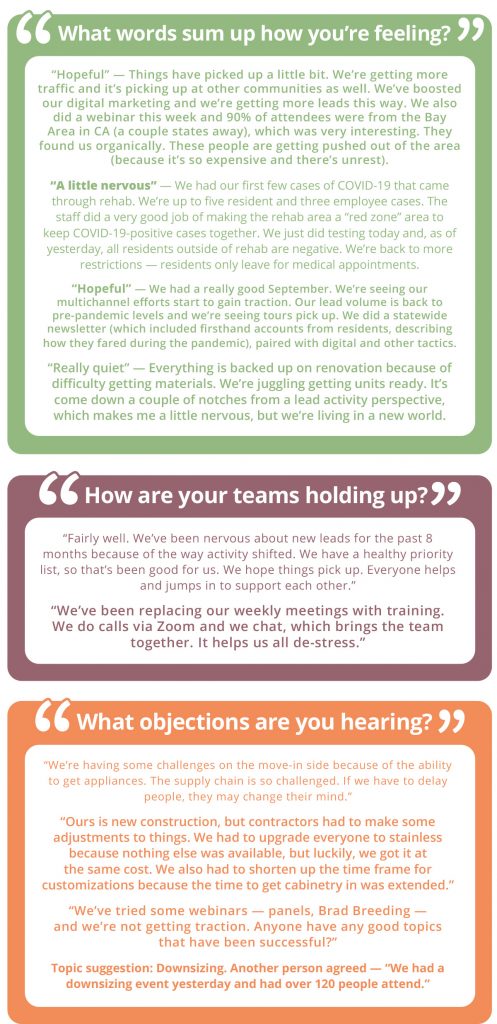

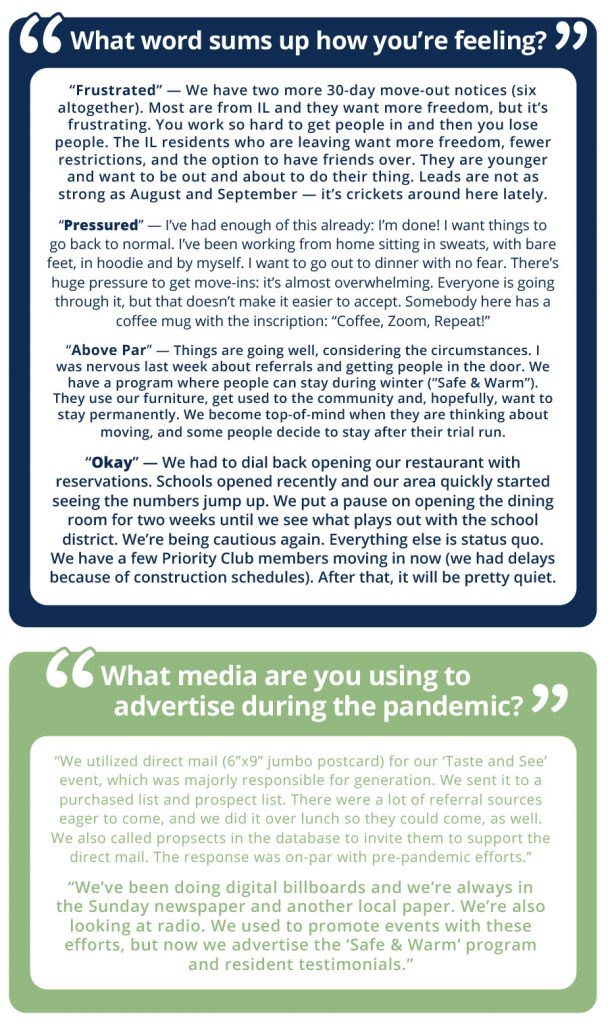

At our 34th sales and marketing roundtable, we shared our successes and setbacks during the pandemic. We were also fortunate to have one participant share takeaways from this year’s SMASH conference.

Check out the recap and conference takeaways below. We also invite you to attend our next roundtable this week.

Takeaways from the SMASH Conference

Over 200 sales and marketing professionals from senior living organizations of all sizes across the U.S. participated. One of our roundtable attendees shared these takeaways:

Biggest Sales and Marketing Trends

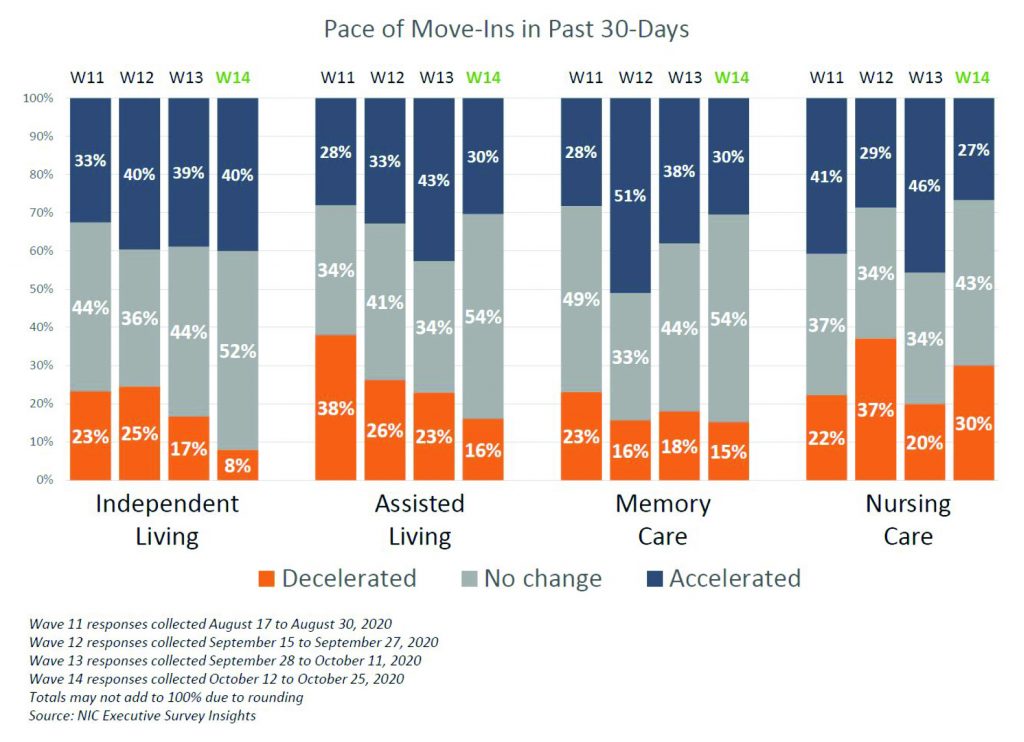

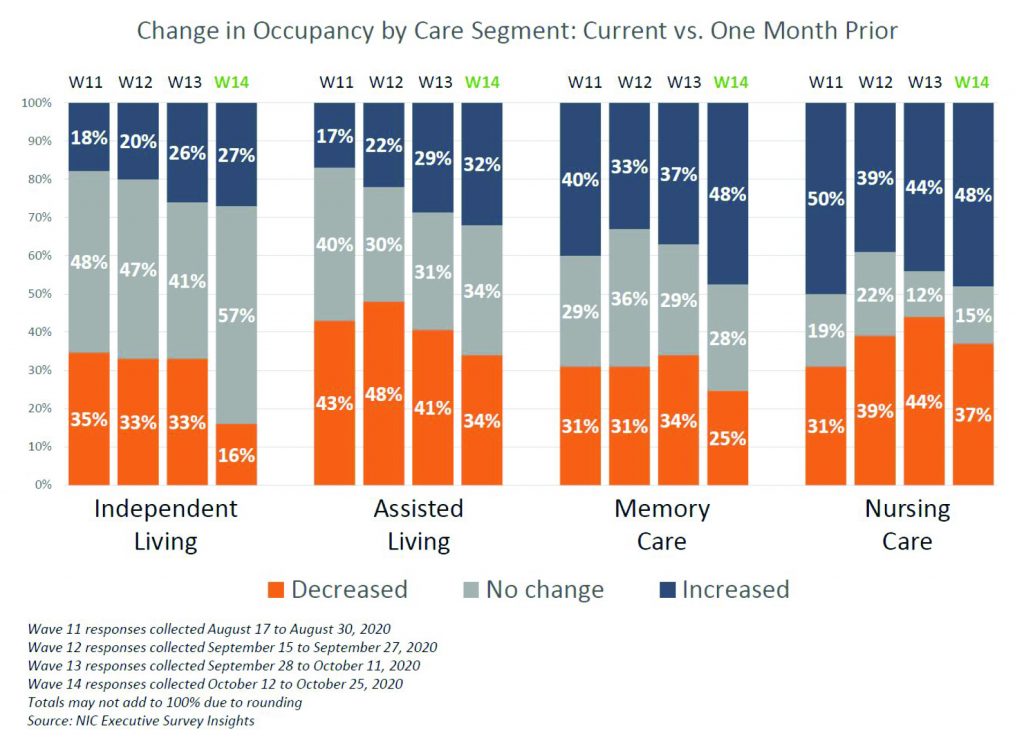

- Since COVID-19, leads and occupancy have plunged across the board.

- The deepest occupancy decreases have been in assisted living, with the toughest objection being “Why would I move my mom into assisted living when I know I won’t be able to see her for months?”

- Marketing budgets are not being cut and, in many instances, they are being increased.

- Marketing dollars are being reallocated from events and on-site activities to digital, SEO/SEM, virtual tours, videos and webinars.

- Marketing automation (automated lead nurture) is by far the #2 marketing priority after digital paid search and search engine optimization (SEO/SEM).

- Marketing messages have pivoted for assisted living and memory care to safety and security. IL messages are still about lifestyle, with a bit of safety and security in the message mix.

- Website — making sure the messages are appropriate/correct for the times. For most senior living communities, COVID-19 info has recently been moved from front and center to a smaller tab on the homepage, still easily accessible.

- Salespeople across the board are still focusing 100% of their time on sales, including nurturing the wait list/depositors, cold calling, working through the database, delivering treats/meals to depositors, virtual tours, apartment tours, answering website/call leads, etc. Activity team members, as well as social workers and front desk team members, are taking care of all window/outside visits, temperature taking, Facetime/Skyping with family members, virtual doctor visits, etc.

- Sales messaging, especially for assisted living — do not lead with COVID-19. We are living with COVID-19 24/7; however, prospects are calling us because mom/dad needs more help. They want to know how we can help them first and foremost.

- “Backstage Pass” — can’t tour the community, but can tour individual apartments.

Interesting Sales and Marketing Stats

- New reality — 90% of prospects do not want to talk with us. They just want more information (which they are finding digitally via Google, website, videos, Facebook, Instagram, etc.)

- Across the U.S. in CCRCs:

- 43% increase in cost per conversion in digital search

- 39% decrease in goal completion (filling out a form, calling, etc.)

- 103% increase in phone calls (these are not all sales calls)

- 70% of adult daughters find care for their parents through digital (up from 50% not so long ago)

- Google will drive 90% of digital leads

- 77% of searches for senior care begin online … even for skilled nursing

- 80% of senior living search online is Google, Facebook and individual community websites

- 6 billion minutes of content per week are consumed via video

- 3 connected devices per person — and we switch between them all day long

- Average number of brand touchpoints = six per person … up from two 10 years ago.

- 92% of consumers begin their healthcare search online — with 6,000 searches related to long-term care EVERY HOUR

- 88% of residents overall would recommend LTC. (Perception: 24% of seniors don’t want to move to LTC. Reality: 88% who live in LTC really love it.)

Please join our next roundtable discussion on Thursday, November 19, at noon ET.

For login information, please contact DDunham@Varsitybranding.com.

‘

‘