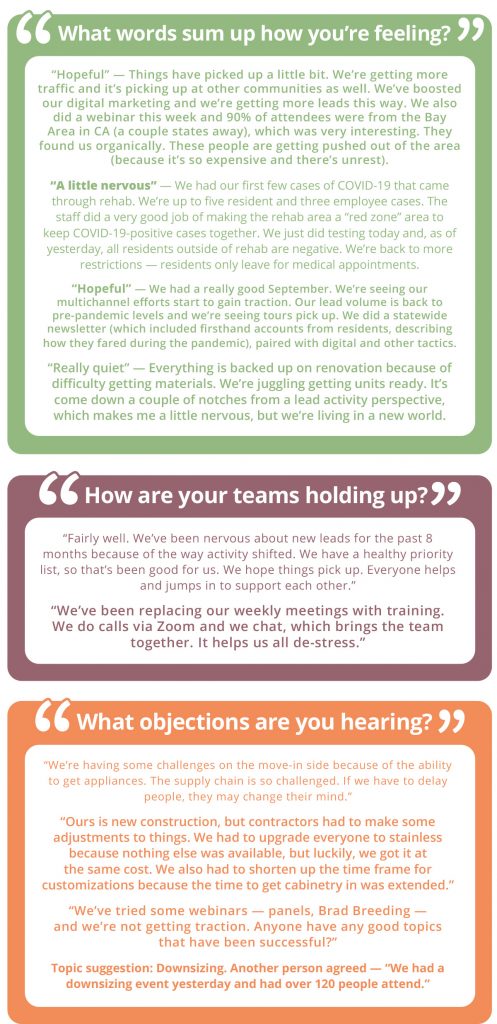

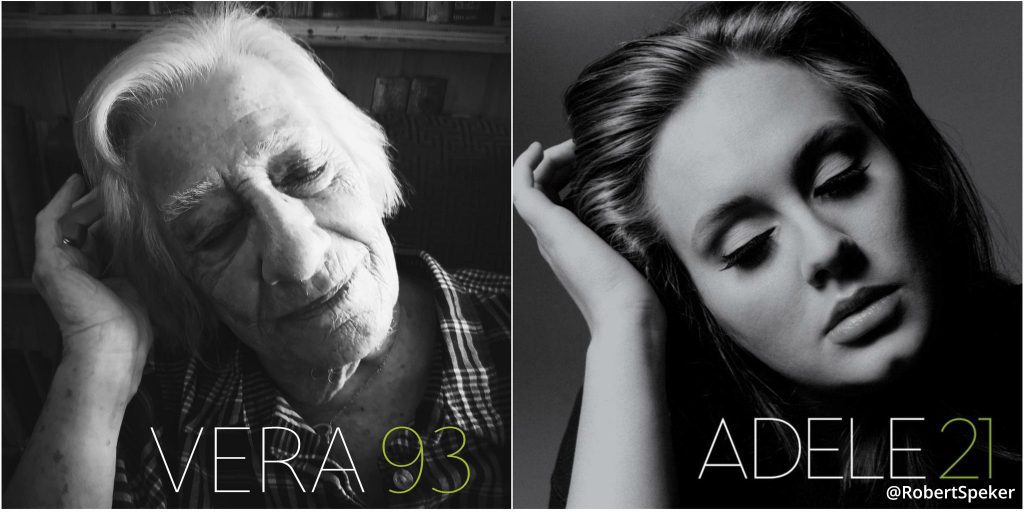

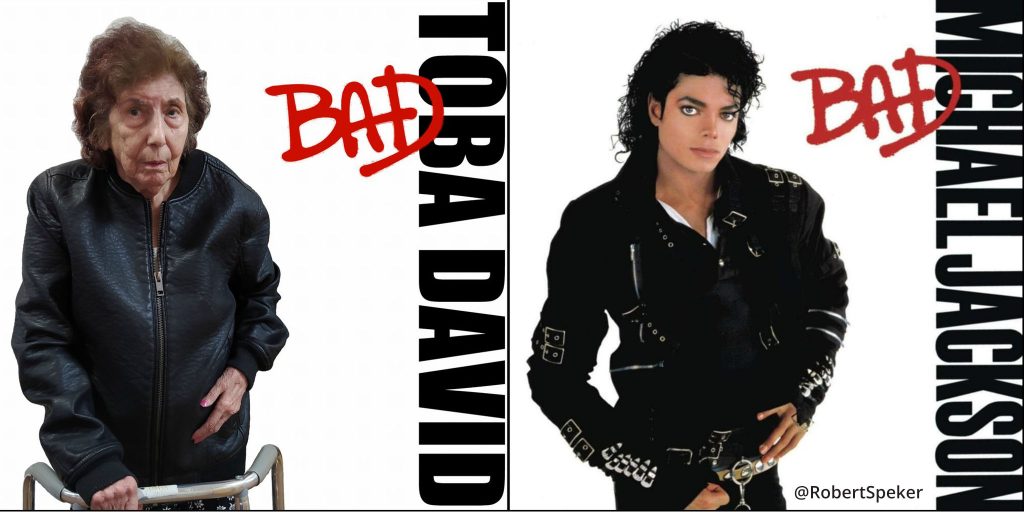

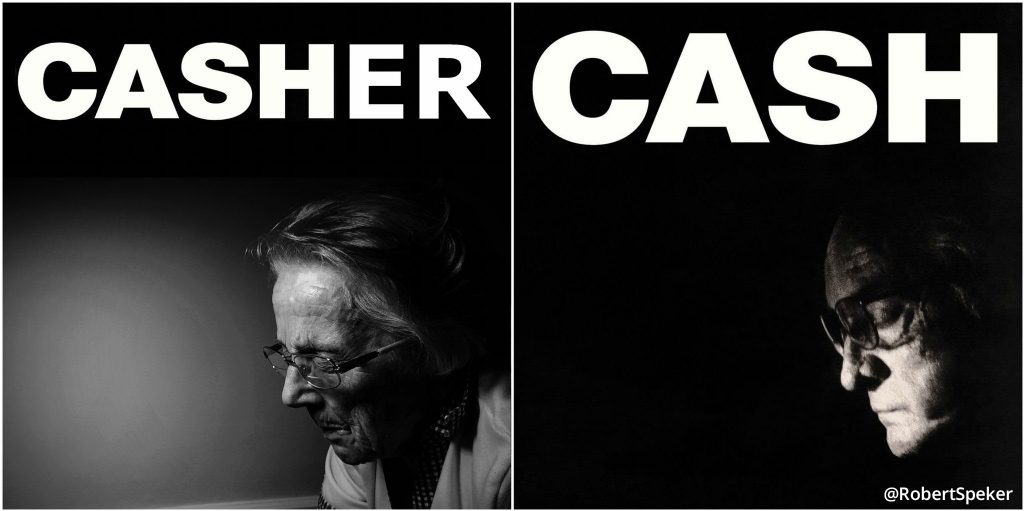

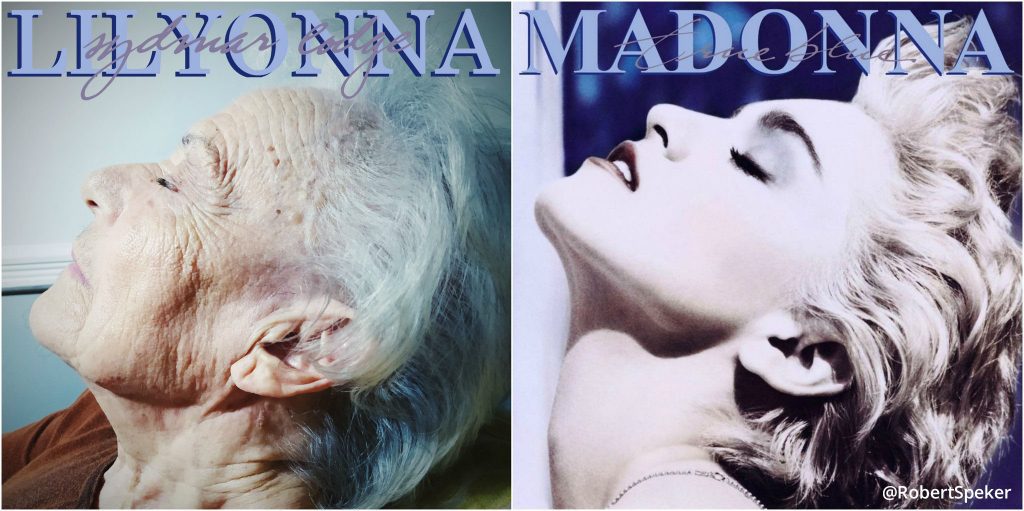

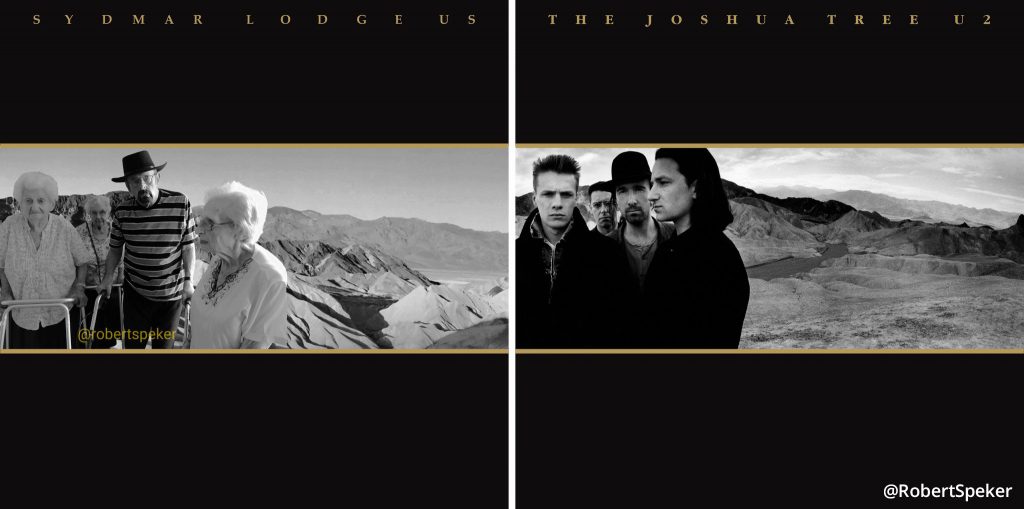

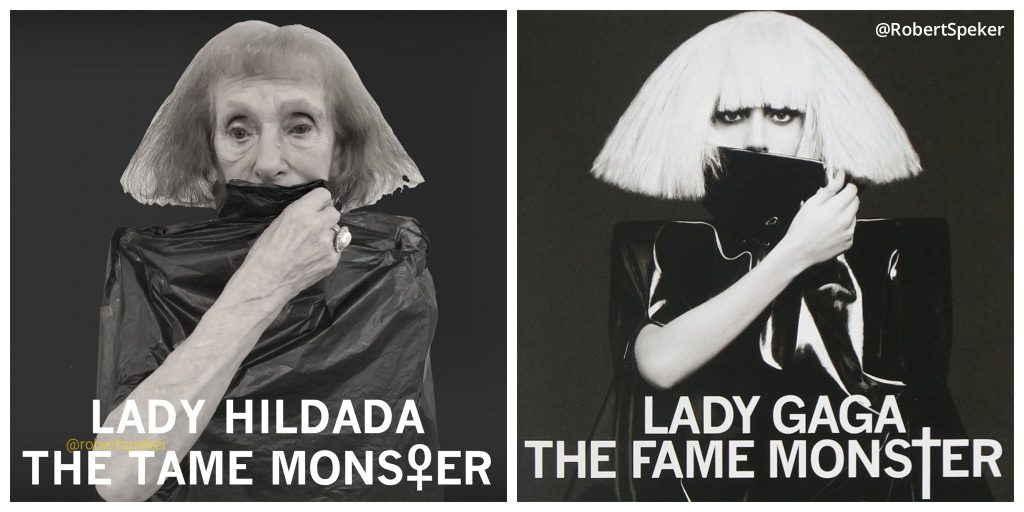

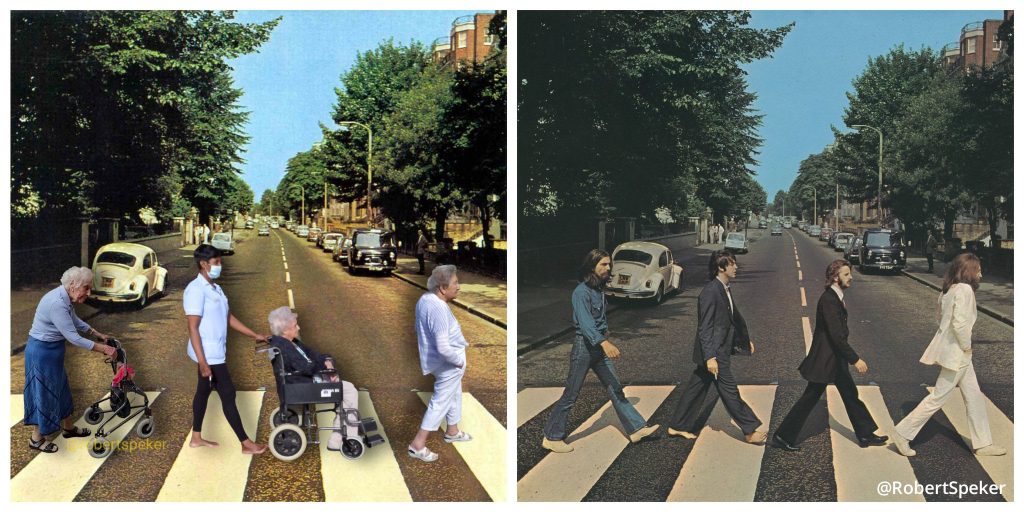

Robert Speker, Activities Coordinator at Sydmar Lodge in Edgware, North London, UK, and his residents have passed the time through lockdown by recreating famous album covers. Posing while wearing similar clothing, makeup and expressions, the residents (and the caregivers as well) have redone album covers by the Beatles, Lady Gaga, Adele, Bruce Springsteen, Michael Jackson, The Clash, U2, Elvis Presley, Madonna and others. And they’re still going.

Robert started this project to keep residents engaged and entertained during social distancing. Rather than passing the time playing bingo or watching TV, he felt they needed something more inspiring to do. It was a huge surprise to all of them when the project quickly went viral on social media and gained international recognition. Robert has done 80 to 100 TV and print interviews, and was gracious enough to talk to Varsity. See his ongoing artistic collaborations with residents at @RobertSpeker on Twitter.

Why did you begin this project?

It was something I’d long thought about, but I don’t usually have a lot of time. However, during lockdown, I had more time to put on different activities with the residents particularly when no family visits were allowed. That was the impetus for me actually starting the project. Once I had explained to each resident what I wanted to do, they got on board really quickly, with great enthusiasm.

What have been some of the highlights of the experience?

There have been many. David Bowie’s widow Iman retweeted it. It’s just a phenomenal thing to know that the love of his life has seen this project and has liked it.

Midge Ure challenged me to do the Ultravox album cover of Vienna, which was just celebrating its 40th anniversary. So I felt the need to be able to do it. After I sent the photo out, he sent a really lovely message. As a special surprise for resident Sheila Solomon’s 92nd birthday, I’d arranged for her to meet Rag’n’Bone Man backstage before one of his concert. He was really lovely with her. He is a huge guy… he gave her a signed album. It was the one with the tattoo, so I knew that I had to get her doing this cover, complete with tattoo, temporary in Sheila’s case.

Sheila also recreated the Clash cover (a redo of an Elvis Presley album). She’s a real character. There’s not many 94-year-olds that still like going to rock concerts! She’s just waiting for lockdown to end so she can go and see Ed Sheeran.

How did you choose the residents and carers for the photos?

It was partly on their look, say, if they had a similar hairstyle, but also based on music preference. They had heard all of the artists⎯they might not know exactly the song, but they all know and have listened to all of the different artists. So it was a case of showing them the album covers. It was interesting to discuss different covers and see how the image appears to someone in their 90s, and then it was a case of matching it in that way and taking some photos.

How did you choose the album covers?

I wanted the covers to be ones which were easily recognizable ⎯ the word “iconic” springs to mind. Even if the photo won’t have the name of either the singer or the group, you’ll know almost immediately who that artist is.

What impact has your project had on morale among residents and staff?

Well, they really have loved doing it. And obviously the global response has just been overwhelming. It’s been absolutely awesome, really phenomenal and so positive. They loved seeing the coverage on TV and in the press. For the residents and the staff to receive such warm wishes from around the world is really heartwarming ⎯ especially in this time when we are still in lockdown. Residents are only seeing their families maybe a couple times a week, if that, literally for 20 minutes, at two-meter distances, with masks on. The positivity was really needed. And while I was doing it just to create some smiles, it has also raised awareness of care homes—the people who are living and are working in them.

Did that play a role in changing the perception of older individuals?

It certainly did, because it made people realize that care homes aren’t this stagnant environment where residents just sit around in a circle, either sleeping or watching television. We try to encourage them to do as much as they possibly can. My mantra is: Use it or lose it. So often I say, if you can do it yourself, do it, because you don’t want to get to that stage where you actually aren’t able to do it; so once you can still do something, do it. And with these photos, they were all able to do it, they all enjoyed doing it. So it was that kind of feeling of knowing how care homes are perceived not only in the UK, but obviously in America and other countries, and we’re trying to knock that theory out of the window.

Are there any residents who said, “Hey, I want to be included”?

Yeah, we had a few, and their family members would get involved by saying, “I think Mummy would be good at this.” Or, “Why don’t we use Dad for this?” Then we’ve got residents saying, “What am I going to do? When am I going to be photographed?”

How did people find out about it?

Initially I sent it out on Facebook, to the families, and then posted on Twitter and Instagram. On Twitter, that’s where it went really completely crazy—just to learn who had seen it and how many people had seen it. I said to the residents, over 11 million people have seen these photos. It’s quite unbelievable.

How were you able to do all the makeup, hair, body painting, photography and editing?

When I’ve got an idea such as this in mind, I like to do it myself, because I know what I need to achieve, rather than trying to explain it to someone else. Also, I didn’t want a lot of people knowing about it, just so that it could be focused on that individual. I could just take them off quietly. There’s no hoo-ha about it. I’d spend 30 minutes or an hour with them. Doing the makeup or the set or the hair.

Can you talk about why you made some of the details in the photos different?

Martin, the gentleman in the Springsteen photo, he’s got his own baseball cap, so I thought, I’m going to use that cap. And I’ve tried to do that throughout, so if there’s an item of clothing that the actual individual has already, then I want that to be in the photo. Sheila had a jumper similar to Rag’n’Bone Man’s, so that’s what I got her to wear. For Hilda and Blink-182 — the model is wearing a red bra, which wouldn’t have been appropriate for her. I showed a lovely red jumper of Hilda’s. Whether it’s an item of jewelry or a piece of clothing, I use things that belong to the residents, to make sure that it’s about them in the photo, not just their body, but also other aspects of their personality.

Have other communities reached out to you about your project?

Yes. Another care home messaged me and said, “We hope you don’t mind, we saw what you did, and we’ve also tried to have a little go at that.” I think that’s a wonderful thing — especially during this time, when other care homes are in isolation — we need to be sharing ideas. And if this can work in other settings, then I’m all for it. It’s not a competition about who can do the best; it’s about making sure that seniors are engaged and have activities to do.

What has been your favorite thing about the project?

Suddenly, our residents are in the spotlight; they are the main talking point, having done something absolutely phenomenal. They have been able to talk so much about this to their peers, to family, to staff. It’s amazing that it’s still carrying on. Which is a beautiful thing.

It’s not only just making somebody smile, it’s the fact that residents are talked about. And it’s not about the famous singers, it’s about our residents. It is really humbling personally for me. I never expected the impact and the response. I’m really overwhelmed, and the residents just absolutely love receiving the messages and can’t quite believe that people in America, Australia and all over the world have seen these photos and want to connect with us.

It has been a lovely ride that we’ve all been on. I’ve really shared it, the whole way, with the residents, which is just a lovely thing.

During COVID-19, Robert and the residents of Sydmar Lodge Care Home are helping others by raising funds for three charities: DementiaFriends.org.uk, Alzheimers.org.uk and AgeUK.org.uk. You can join the cause by donating through their GoFundMe page or by ordering a charity calendar they’re creating. Watch Robert’s Twitter page (@RobertSpeker) to see when the calendar comes out and how to order it.

‘

‘

J

J