Derek

By Derek Dunham, President

New Research Shows Interest in Community Living is Shifting

At our weekly sales and marketing roundtable, aging services expert Scott Townsley, principal of Trilogy Consulting, LLC, joined us to discuss consumer research and other insights related to the pandemic.

Check out the takeaways below. Please also join us for our next roundtable, coming this week.

Highlights from presentation on consumer research by Scott Townsley, Principal, Trilogy Consulting, LLC:

Opportunities are already emerging amid COVID-19—this will change who we are as a field and will change the product. Here are some resources that can be helpful as you deal with this situation.

The End of Competitive Advantage and Seeing Around Corners, two excellent books by Rita Gunther McGrath

- “Inflection point” is a key concept she discusses, which she describes as jerking the steering wheel while driving

- Unfortunately, by the time you recognize an inflection point, it can be too late; for example, discovering that occupancy has dropped from 96% to 80%, and it’s not going back up

- My observation is that skilled nursing is at an inflection point—it was already changing, but the coronavirus has pushed it to this point—and that a portion of it will be forever changed

- Life Plan Communities aren’t at an inflection point yet, but we need to have our eyes wide open

Nonsense: The Power of Not Knowing, by Jamie Holmes

- “While uncertainties can be painful, they are also, by definition, eras of change. They’re destabilizing because they’re a threat to the status quo, which is also precisely why they represent an opportunity for innovative and cultural rebirth.”

- The risk is that we seek information or anecdotes that hint we’re returning to the “way things were” sooner rather than later—rather than seeking actual data

- We can’t look to the past (even January 2020) for clues about the future, because we’re probably going to be wrong; I refer to it as the “perilous backslide to the status quo,” in which we will innately make decisions thinking things will get back to “normal”

- Virtual tours are a great example of how we’ve adapted

- When I first saw a billboard for telemedicine, years ago, I thought, “Who’s going to want telemedicine?” But without it, many people (particularly in skilled nursing) wouldn’t have been able to see their physicians; we went from talking about it to it being a key part of life

Consumer Behavior Survey

We just completed a 1,000-person survey of four market areas in Pennsylvania (southeastern, south-central, west-central and northeast), one in Maryland and one in Delaware.

Too often, we’re talking in anecdotes, but we need to use data that tracks consumer behavior. This is especially risky when talking about the coronavirus.

- Background on the study

- Participants are 60 to 80 years old; all income groups

- Conducted last week in July/first week in August

- Asked approximately 50 questions

- All telephone conversations (landline and mobile)

- Allowed us to reach the “essential non-customers”

- With people at home, it was easier to reach them; they’re still answering their phones

- Completed 1,000 surveys in five days

- What’s key is that this survey has statistical validity—it provides insight into the thinking of consumers rather than anecdotes

Early on, it was clear that we (as an industry) knew neither the questions to ask nor the answers. Today, there’s more clarity about the former (the questions that we, as an industry, should be asking) and an ability to obtain the answers. Hence this survey.

We asked the question, “How concerned are you about coronavirus in your area?” Seventy-eight percent are very or somewhat concerned about the coronavirus in their area. For those whose adult children are involved in making decisions about retirement living options, that number increases to 87 percent.

It’s also notable that, in this and prior surveys:

- The percentage of people who are concerned about future long-term care needs is typically low

- The percentage of people who are concerned about their ability to afford their retirement is also low

- The percentage of people who are concerned about dementia or Alzheimer’s, for themselves and those they love, is incrementally higher than the other two—but still a fraction of those concerned about the coronavirus

We then assessed the impact of COVID-19 on Senior Living Community (SLC) interest later in the study:

- By and large, every cross-tab is very or less interested due to the coronavirus

- With respect to SLC interest, there are as many people who are less interested as there are who are more interested—due to the coronavirus

- Interestingly, people who identify as evangelicals are 17% less interested in senior living communities than the average (due to the coronavirus)

- There’s still a core of people who remain interested, which may be proving the naysayers wrong, but: (a) it’s too soon to know for sure, and (b) the coronavirus has significantly reduced interest in senior living “congregate”-type options

- The field could be in jeopardy if the virus stays around

- The virus has, conversely, also made some people more interested

- Note: This study won’t be valid six months or a year from now—everything is changing so quickly

- It’s critical to talk to people who are “the essential non-customers”—those who are living outside the senior living world (and who aren’t on your lists)—to understand who is motivated and why

- Ask how they feel about congregate living on their overall health and well-being

- In unprecedented times, we need to rely on information that’s current

- I was wrong about the recession in 2008–2010—I thought the loss of value in portfolios would have a searing effect on people’s decisions about senior living, much in the way the depression impacted how people spent money

- This didn’t happen, and the for-profit sector took advantage of that

- The not-for-profit sector did not jump on it

- It’s possible that, six months from now, if there’s an effective vaccine, the consumer could forget about this—but it’s also possible that it will stay with them for a long time, perhaps forever

- It’s important to note that concerns about the coronavirus did not increase the interest in a stay-at-home program (though the percentage of people “very interested” in a stay-at-home program is twice what it is for a senior living community)

- HJ Sims is soon coming out with a national study that will be fascinating to review; it, hopefully, will include all regions of the country, not just those heavily impacted by COVID-19

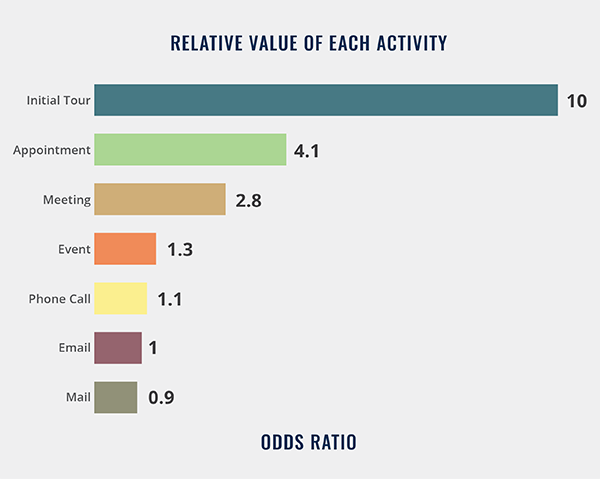

- The secret to success is data analytics, and WildFig (Varsity’s sister firm) is ahead of the curve

- “You never let a serious crisis go to waste. And what I mean by that: It’s an opportunity to do things you think you could not do before.” – Rahm Emanuel

Please join us for our next roundtable discussion on Thursday, September 17, at noon ET.

For log-in information, please contact DDunham@VarsityBranding.com.

‘

‘