At our weekly sales & marketing roundtable, we all shared creative tactics we’re using to attract prospects as COVID-19 rates spike in some areas. We’d especially like to thank Lana Peck, senior principal at the National Investment Center for Seniors Housing & Care (NIC) for sharing the latest insights from executive surveys completed since the pandemic hit.

Check out the insights and survey results below. We also invite you to our next roundtable this week.

NIC Executive Survey Insights with Lana Peck

The full report is on the NIC website. Wave 14 findings can be found here.

We had 70 organizations respond to wave 14:

- Not the same 70 for every wave, but 60–70% are repeat takers, so there is some continuity.

- Geographical dispersion of respondents:

- There’s a slight underrepresentation in the Northeast compared to national coverage of the NIC map.

- For the most part, participants are coming from all over the country.

- We’re promoting this more strongly with operators, as we’re getting some national media exposure.

- It is important for operators to know that, by participating in the survey, they have the opportunity to ensure that the narrative is accurate.

‘

‘

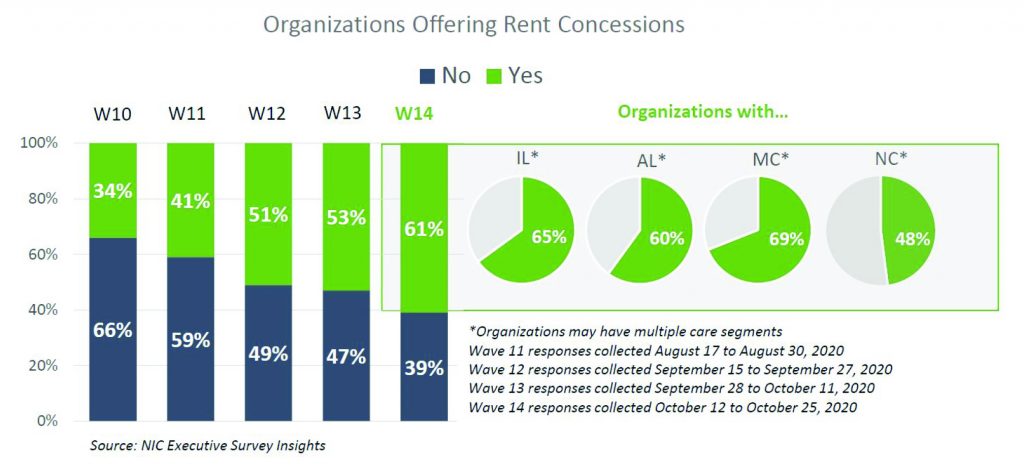

- We went from ⅓ in wave 10 (early August) to just under ⅔ in the most recent wave — a lot more organizations are offering rent concessions.

- 90% of organizations are paying overtime to mitigate staffing issues.

- Staffing/temp agency usage has grown throughout the pandemic.

- About ⅔ of organizations that have IL in portfolio are offering rent concessions.

- Organizations with nursing care are less likely to offer rent concessions.

- Discussion from the group:

- We are giving concessions on entrance fees and support on moving services.

- We are offering $3,000 toward moving expenses and incentives to get people to move more quickly.

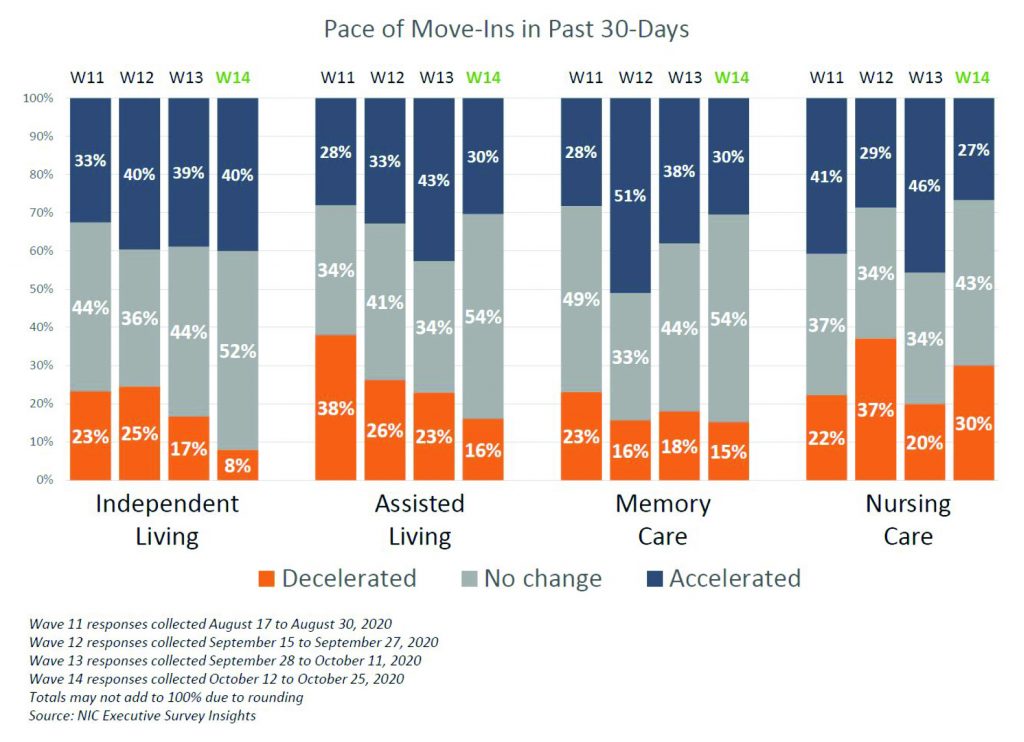

- Organizations reporting no change in pace have been growing. It’s the highest it’s been in wave 14.

- Deceleration of move-ins is lower in IL, AL and MC in wave 14.

- Most respondents are citing increased resident demand (increase in move-ins).

- Fewer organizations with nursing care beds in wave 14 reported acceleration in the pace of move-ins, with the fewest respondents citing hospital placement since wave 7 surveyed mid-May — presumably due to anecdotal reports of hospitals sending patients straight home to recuperate from surgeries or illnesses with in-home health care.

- A quarter of organizations have a backlog of residents waiting to move in.

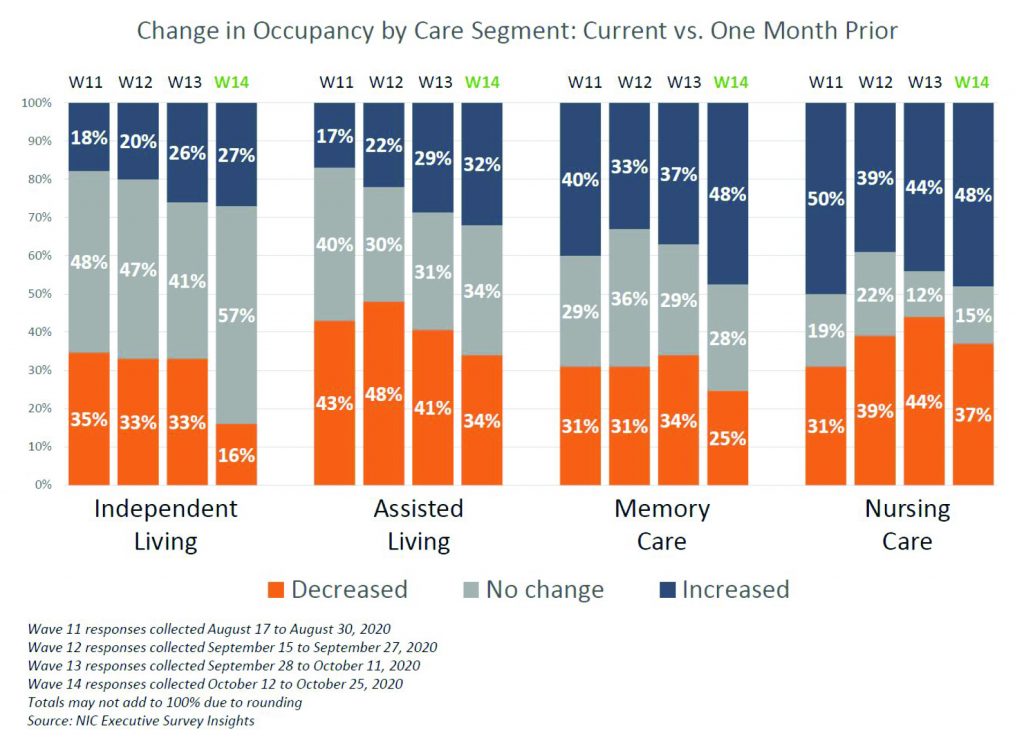

- Organizations may be providing incentives. The month-over-month change in occupancy has been starting to rise.

- About ¼ of the organizations that have IL in their portfolio; ⅓ of those with AL; ½ of those with MC; and about ½ with nursing care are seeing an upward change in occupancy rates in the past 30 days.

- Fewer folks that have IL are seeing a decrease in occupancy.

- 48% in nursing care are seeing increases, and 37% are seeing decreases.

Please join our next roundtable discussion on Thursday, November 5, at noon ET.

For login information, please contact DDunham@VarsityBranding.com.