At our weekly sales and marketing roundtable, we all shared creative tactics we’re using to attract prospects as communities gradually open back up.

We’d especially like to thank Lana Peck, Senior Principal at the National Investment Center for Seniors Housing & Care (NIC) for sharing insights gleaned from 11 waves of executive surveys, all completed since the pandemic hit.

You’ll find discussion highlights and survey results below. We also invite you to join us for our next roundtable, coming this week.

NIC Executive Survey Insights

We were joined by Lana Peck, Senior Principal at NIC.

Lana:

NIC is a nonprofit organization with a mission to enable access and choice for America’s seniors through data, transparency and making connections.

We’ve been doing our executive survey, since 3/24/20, with 11 waves of data so far. Our audience is C-suite executives and owners/operators of senior housing properties across the country.

We would encourage each of your executives to email insight@nic.org to take the executive survey.

Some highlights from the results so far:

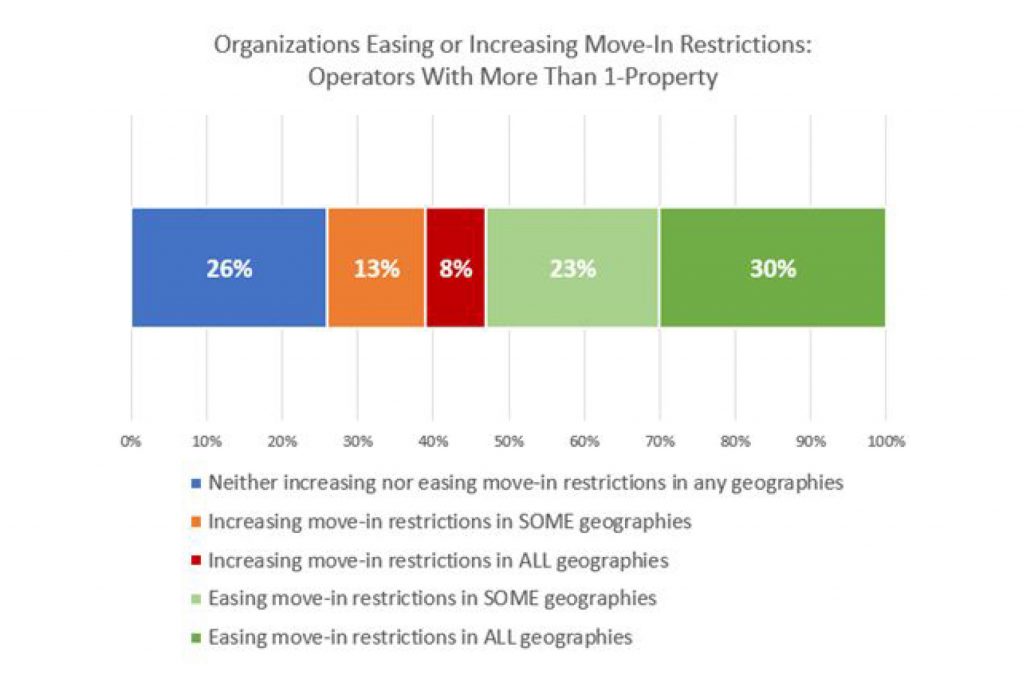

- Wave 10 = 53% (mid- to late July)

- About half of organizations with more than one property are easing restrictions

- Wave 11 = 63% (late August)

- Even more are easing move-in restrictions

Note: blue = good; orange = bad

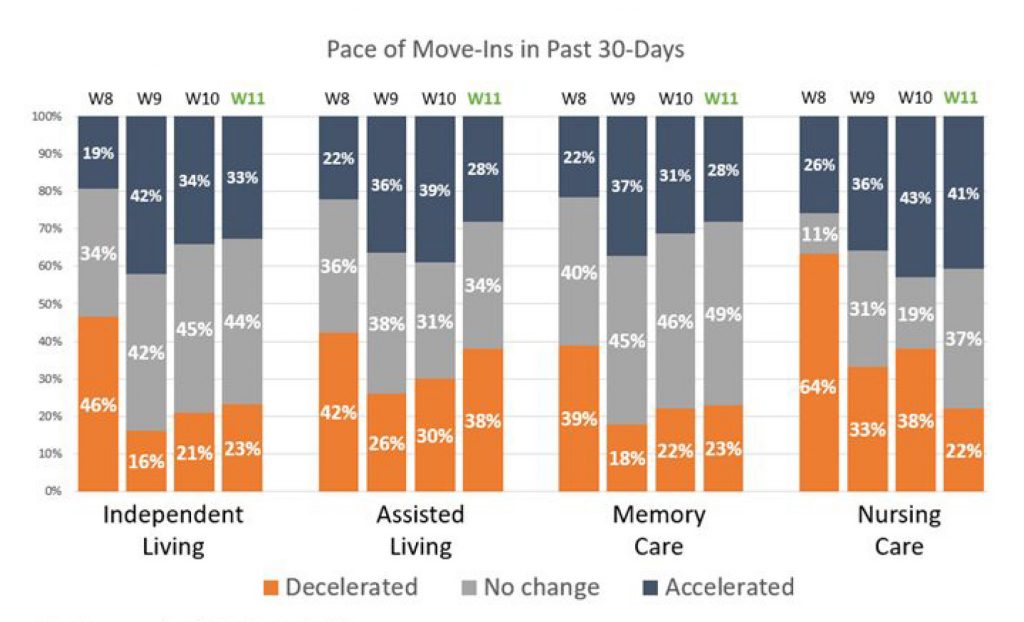

- Wave 8 (around Memorial Day)—we start to see an improvement and a downward trend in decreasing occupancy (directional changes in occupancy by care segment across the respondent’s portfolio of properties—single-property operators included)

- Mid- to late August sees pullback in move-ins for AL

• Note: blue = good; orange = bad

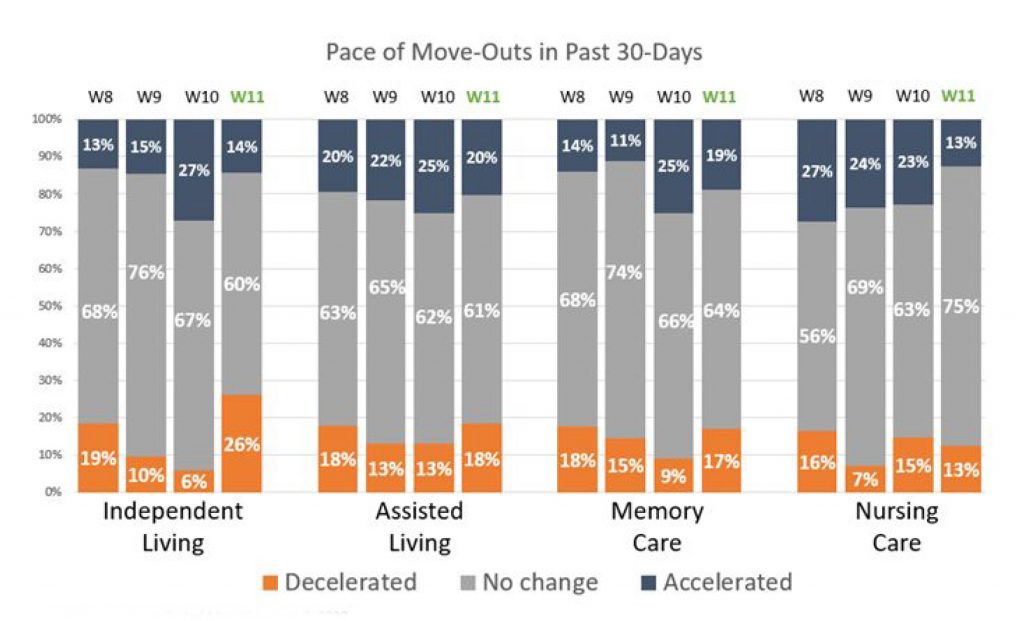

• Across the board, the pace of move-outs hasn’t changed tremendously (gray bars)

• Around Memorial Day, we see some improvement, with fewer organizations reporting acceleration in move-outs

• In mid- to late August, we see a pullback in acceleration again

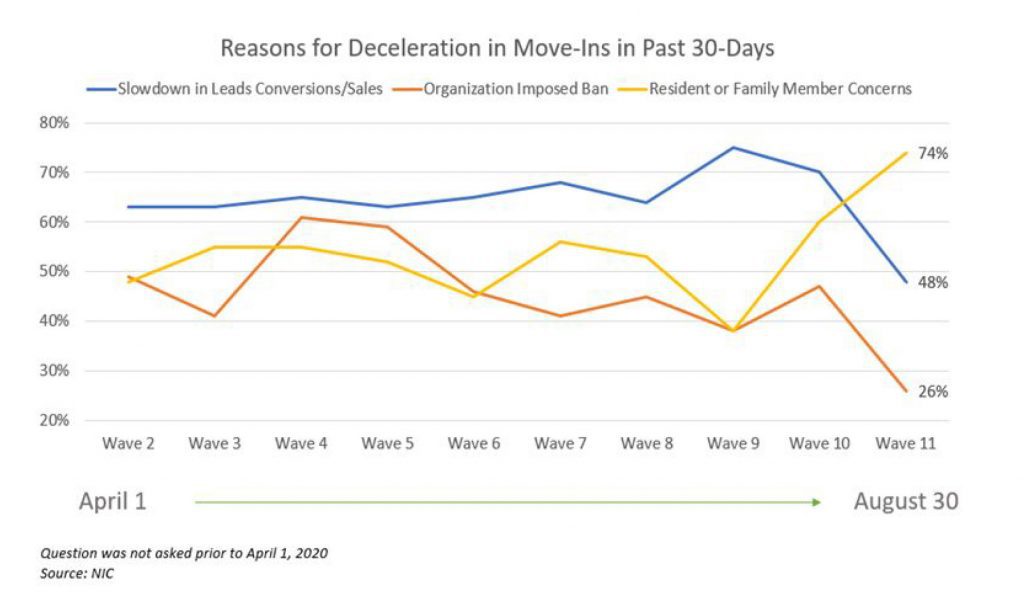

- The recent decline in a slowdown in leads/conversions is due to easing moratoriums and pent-up demand (especially in IL) when doors opened, and people waiting in the wings could actually move in

- When the blue line goes down, that’s a good thing—it’s a reverse in the slowdown of leads and conversions

- The orange line has been trending lower—about half of organizations eased move-in restrictions

- Yellow line—only about half of organizations initially felt that resident or family member concerns contributed to deceleration of move-ins, but this has increased quite a bit, possibly due to a resurgence of COVID-19 or issues of residents not being able to see family members. This is a significant factor in more recent waves of the study.

- This slide is aggregate and shows all care segments

- Leads, conversions and sales are happening more frequently as of more recently. Before, there was an inability to have people on campus to make sales.

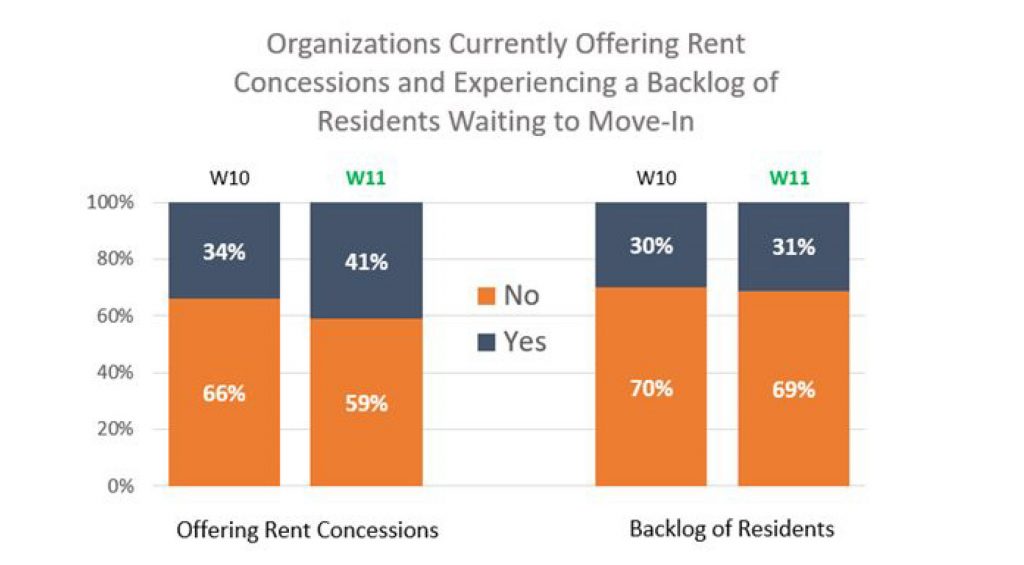

- This shows the toll of the pandemic on organizations—how many are feeling the need to provide incentives to bring residents in. For the most part, most are not reducing rents or fees at this time.

- The majority of respondents don’t have a backlog of residents waiting to move in.

Valuable Resources NIC Offers:

- NIC’s Fall Virtual Conference. The conference will start on October 3. Week 1 will focus on education. Week 2 will be about making connections and business contacts in peer-to-peer discussions. Anyone who signs up for the conference will be able to participate in Community Connector—essentially a LinkedIn for senior housing.

- COVID-19 Resource Center. Data, analytics and connections to help provide transparency to the sector and keep communities informed.

Please join our next roundtable discussion on Thursday, October 1, at noon ET.

For log-in information, please contact DDunham@VarsityBranding.com.